Why it is important for Financial Institutions to adopt Cloud Computing

To Cloud or Not to Cloud

“It’s all about the customers”

At the end of the day – the objective of every business is to maximize customer mindshare. And this is even more prevalent in the finance & banking industry. The primary focus of any financial institution or bank is the transformation and optimization of their customer's banking experience. Given the level of customer obsession, it is important for financial Institutions & banks to chart their journey forward possessing a great understanding as to where they intend to be and why.

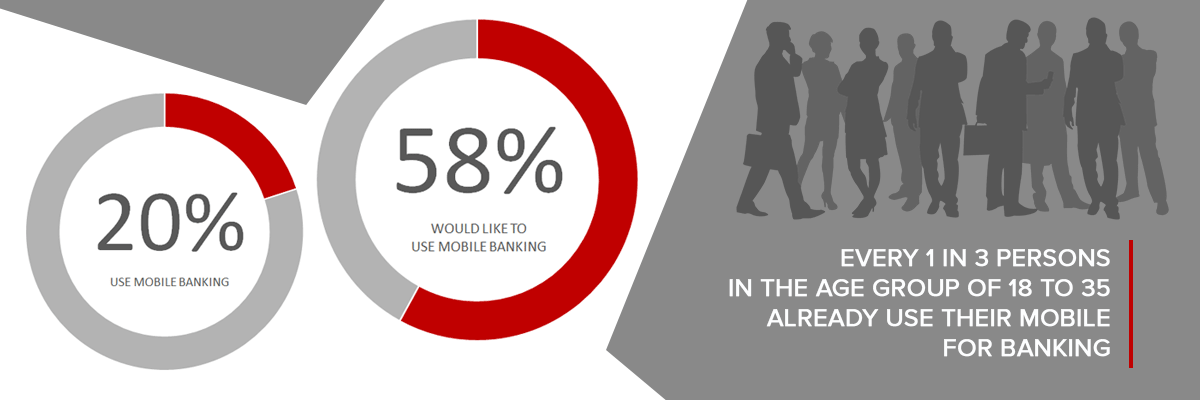

Over the years, especially in the last decade - technology and digital transformation has taken over almost every aspect of our lives considering the introduction of highly efficient computers and smartphone devices. The same applies for banking and financial institutions as well. Gone are the days when a customer had to go to a bank for transactions – today a customer can execute multiple transactions, apply for credit cards and loans by simply accessing their online accounts or mobile applications with the power of the internet.

This increasing trend of digital transformation highlights that users and customers today prefer a system that is safe, secure, easy, quick and above all, convenient. What this means for businesses, and in relevance to our topic, financial institutions, and banks, is to be able to constantly innovate and meet these digital consumer trends and requirements. To be able to constantly evolve, be agile, develop, and innovate requires businesses to significantly invest upfront capital in real estate, technology and manpower, and the subsequent costs in managing, maintaining, and running these environments. There is also the very important question of whether the businesses have sized their requirements efficiently, risking under or over-provisioning their environments – which is neither beneficial for the business or for their customer experience. This is how many businesses start to explore cloud. Since cloud computing provides flexibility, agility, security, low or no upfront capital investment, it allows the business to be flexible and agile, and try and meet customer expectations head-on by focusing more on the business aspects of things rather than worrying about maintaining and managing complex data centers on premises.

When it comes to financial institutions and banks, one of the biggest challenges of moving to cloud is security, or to rephrase better, the general misconception of lack of security on cloud. While the banking industry has always been adept at protecting people’s data, new regulations have made customer data security an even bigger priority. This tightening of data security has been so broad reaching in its effect that certain information is much less accessible to marketers who want to leverage it for more personalized and relevant messaging.

Keeping all of the above in mind, the following are some of the key benefits for financial institutions and banks to adopt cloud computing.

Key benefits for financial institutions and banks to adopt cloud computing.

Significant reduction in capital expenditure towards data centre and minimal data centre footprint: it is common for financial institutions to spend millions of dollars to build huge performance and high-security data centres. Data centres not only include the cost of the equipment, but also the cost of real estate required to host the data centre, power and cooling, manpower to manage and maintain these equipments among many others. Shifting workloads onto the cloud allows financial institutions & banks to significantly save on upfront capital expenditure and reduced cost of infrastructure operations & management

Bring new products and features to the market in a matter of weeks, rather than months or years: With the adoption of cloud & powering agile DevOps processes, one can test multiple workloads and environments to evaluate, innovate, & experiment without having the hassles to invest in heavy infrastructure (which is sized on assumption provisioning), going through a rigid approval process with management-specifically owing to budget, and without the risk of hardware failure impacting critical project timelines. Cloud computing provisions the culture of innovation, experimentation and immediate recovery from failures compared to on-premise allowing project teams to function with agility and flexibility

Increase in the quality of customer relations: by using cutting edge AI and machine-learning to understand data and behaviour patterns and subsequently using this data to optimize and deliver intelligent customer-service solutions

Use of analytics and AI to observe patterns and subsequently predict the stock trade and market trends. The large AI neural network recognizes winning patterns from large amounts of data owing to cutting edge ML. Tapping into this can also educate the patterns of winners if mapped backwards and eventually these patterns can be implemented based on probability.

The benefit of teaming up with Aspire NXT is allowing you to focus on growth and doing what you do best, while we take care of things we do best.